How big is the adoption of AI in companies?

It’s been over three years since OpenAI launched ChatGPT for public use. They report 800 million active daily users, yet they face stiff competition from Google Gemini. Even so, "ChatGPT" has become the ubiquitous term for AI—the brand name known by older, less tech-savvy generations. Simultaneously, these AI companies are securing massive investments, seemingly unconcerned with a near-term break-even point.

As a product manager, I'm trying to answer two key questions: Who is the main enterprise user? and How advanced is AI adoption within companies? We constantly see quotes promising "superpowers" and 10x productivity gains. For me, the journey began with a simple, high-leverage question: What is the better way to become 10x more productive than by leveraging a powerful, free AI tool like NotebookLM?

The Research Journey: From Frustration to Focus

I started by asking Claude and Perplexity for a list of 50 relevant links. This quickly led to a common frustration: Large Language Models (LLMs) often default to a 2023/2024 knowledge cut-off. I ran out of free credits before getting a clean list, one of the many minor friction points of current AI usage.

My goal was to feed a comprehensive list of source links into NotebookLM. This is a powerful research method because it summarizes the sources, allows for Q&A against the combined data, and—most excitingly—generates infographics. After several days of refining my prompts, I finally honed in on the cornerstone of my research: I needed perspectives from different angles, which also led me to three insightful reports:

The Decision Maker (CEO): The one setting the company's strategic direction.

Source; IBM CEO Study

Focus: Strategic priorities and investment outlook.The AI Provider (Vendor): The one looking at usage data and numbers.

Source: Anthropic Economic Index

Focus: API usage patterns and economic impact.The Implementer (Employee): The one driving day-to-day usage.

Source: McKinsey State of AI

Focus: Employee adoption rates and workforce impact.

These three articles paint a vastly different picture. It was time to synthesize them in NotebookLM to reveal the key highlights.

The Outcome: Key Highlights & The Infographic

So I want to emphasis on some highlights that are important from my point of view:

CEOs are highly focused on AI adoption, with 61% of leaders reporting their organization is actively adopting AI agents and preparing to implement them at scale, based on a survey conducted in the first quarter of 2025. However, actual widespread rollout has been slower than anticipated, as 60% of CEOs reported being in the piloting phase in early 2025

51% of investments are projected to focus on efficiency and cost savings (up sharply from 22% reported earlier).

While CEOs are optimistic, historical success metrics are mixed. Over the past three years, only 25% of AI initiatives delivered the expected Return on Investment (ROI), and just 16% scaled enterprise-wide.

61% of CEOs agree that competitive advantage depends on possessing the most advanced generative AI

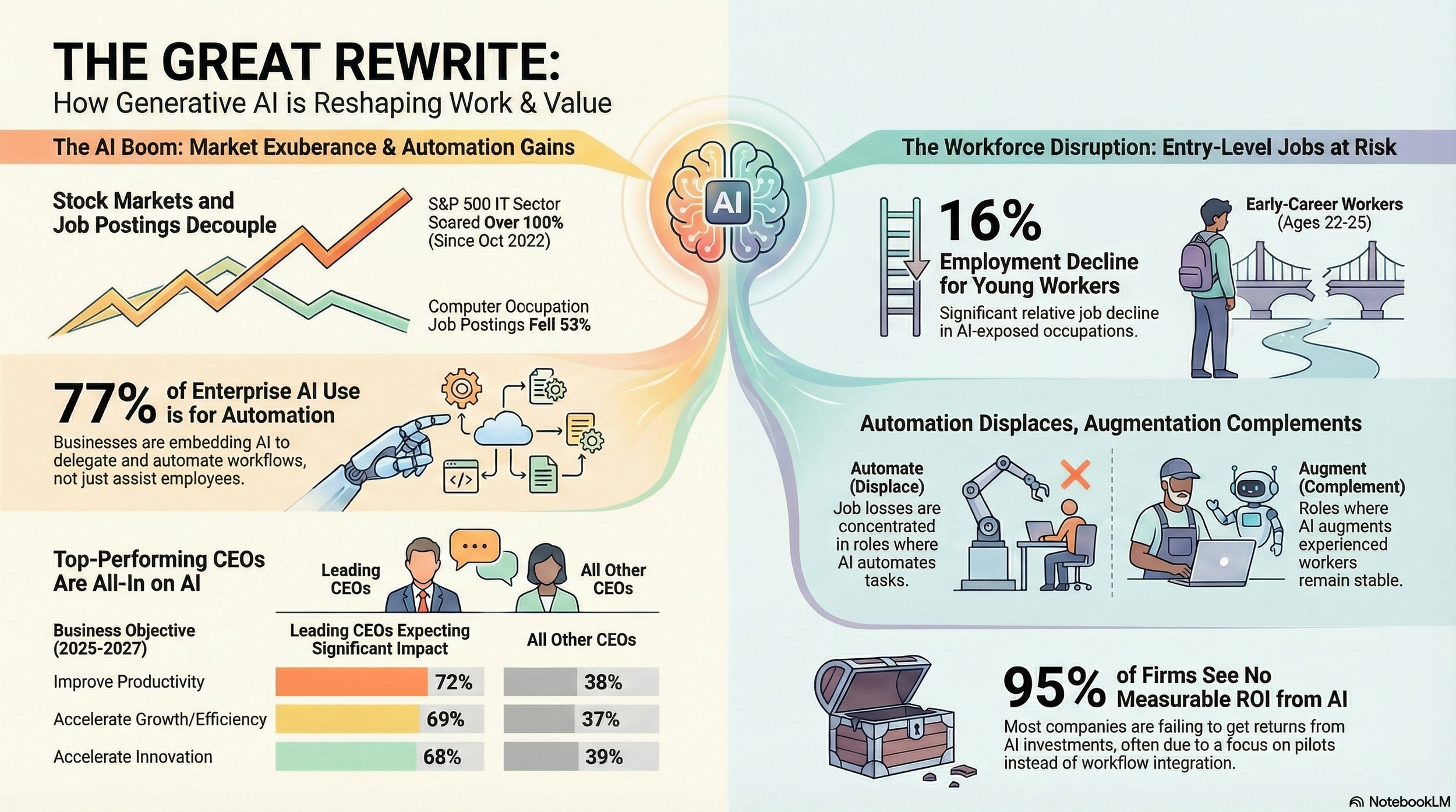

A staggering 77% of enterprise API usage of the Claude model is linked to automating tasks, reflecting direct delegation rather than collaborative assistance

The adoption rate of generative AI among U.S. employees reached 40% by mid-2025

Employment for early-career workers (ages 22-25) declined substantially in AI-exposed occupations like software development and customer service representatives after late 2022. For software developers aged 22-25, employment declined nearly 20% by September 2025

And most importantly the infographic!

I love the visual synthesis and its accurate connection to the research data. For future versions, I'd like the ability to pick and choose exactly what goes into the graph, including custom icons, but this is a fantastic starting point.

General conclusion

The system operates as a clear feedback loop:

Investors/Lenders pressure CEOs for greater business efficiency.

AI Companies promise to deliver this efficiency via automation.

Employees are pushed to multiply their output with AI, which in turn reduces the need for entry-level positions.

Looking at the macro-economic perspective since ChatGPT’s debut, this dynamic creates a dual squeeze: Retirements mean fewer high-earning salaries contributing to the economy, and the reduction in entry-level jobs means "new blood" can't get on the earning ladder. Fewer people are spending, yet stock prices continue to surge, primarily for the AI providers and the corporations making efficiency gains.

This context makes the ongoing conversation around Universal Basic Income (UBI) less of a theoretical debate and more of an economic necessity in the near future.

My next posts will focus on change management and achieving better AI adoption results, and also taking a deeper look at the rising story of UBI.

Meanwhile, what are your thoughts? Does your company's experience align with these numbers?